Hepiyi Insurance Enhances Digital Customer Experience with Exairon

Hepiyi Insurance Enhances Digital Customer Experience with Exairon

About the Customer

Hepiyi Insurance is an insurance company that aims to add value to the insurance sector and make its customers' lives easier with the innovations it implements, drawing on the 61 years of experience of Doğan Holding.

With its innovative products, strong technological infrastructure, and customer-focused service approach, Hepiyi Insurance stands out among Turkey's most valuable and preferred insurance companies.

Speed, accuracy, and seamless communication are key elements of customer satisfaction in the insurance industry. Hepiyi Insurance has initiated a significant transformation in customer experience by partnering with Exairon to meet these needs and manage digital touchpoints more effectively.

With this integration, Hepiyi Insurance aims to increase the efficiency of its internal teams and offer a more consistent and faster experience to its customers by consolidating its operational processes under a centralized structure.

Effective Digital Communication via WhatsApp

Thanks to the Exairon infrastructure, Hepiyi Insurance uses the WhatsApp channel operationally in an active and segmented manner. Four separate WhatsApp lines, each defined to serve a different need, ensure that operations proceed with the right teams and without delay.

This structure allows customers to quickly receive support through the channel best suited to their requests.

Centralized Management of Customer Experience

Hepiyi Insurance centrally manages all its operational processes through the Exairon Platform under four main headings:

Sales

Customer Service

Claims Processes

Solution Team

Exairon's effective role in inbound and outbound communication processes enables customer requests to be matched with the right teams and the process to be tracked end-to-end.

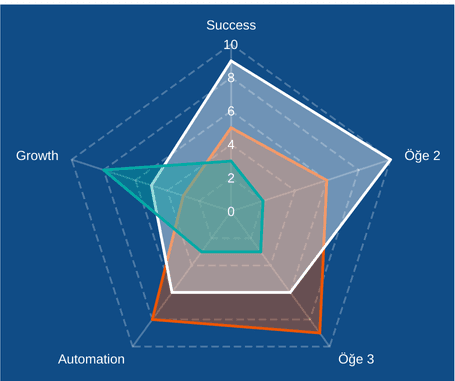

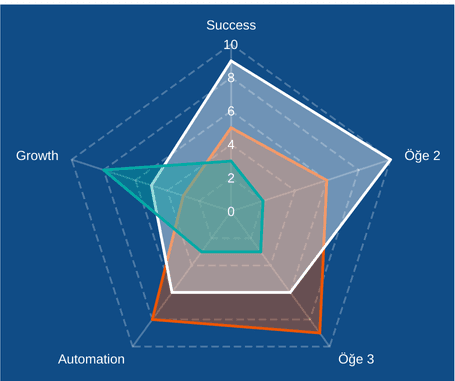

Automation-Supported Operational Processes

In addition to announcements and informational messages, reminders for missing documents and invoices, especially in claims processes, are automatically generated through the Exairon infrastructure. This automation approach:

Reduces delays in processes,

Lightens the operational load,

Ensures transparent and regular communication with customers.

Campaign and Opportunity Processes

Hepiyi Insurance also manages campaign and opportunity communications centrally and with automation support through the Exairon infrastructure. Marketing-focused campaign announcements, personalized/segment-specific opportunity messages, and periodic notifications are delivered to relevant customers at the right time through planned designs. This approach:

Ensures continuity and consistency in campaign communications,

Facilitates the delivery of the right message to the right target audience,

Increases team efficiency by reducing the need for manual operations,

Supports response and conversion rates by enhancing the customer experience.

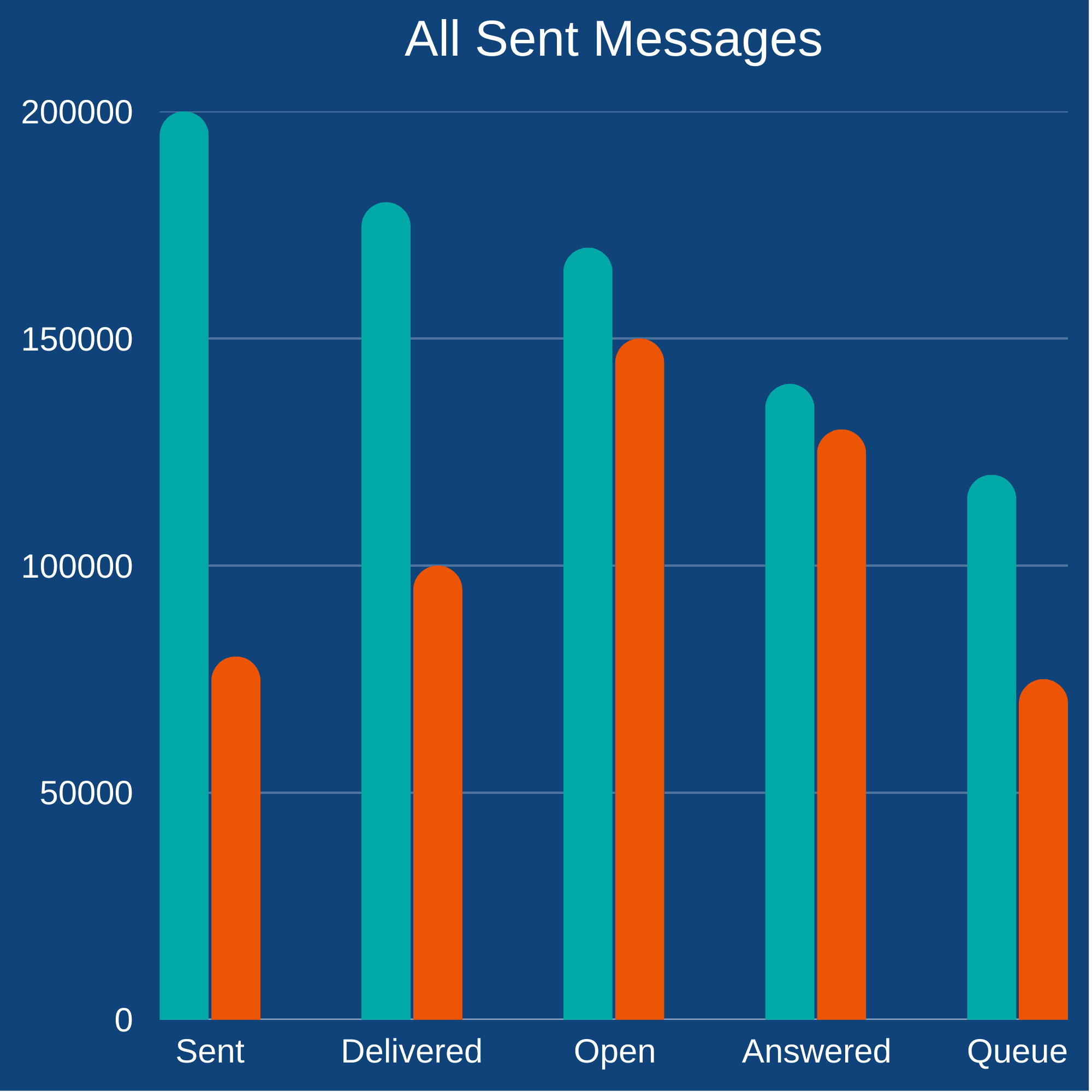

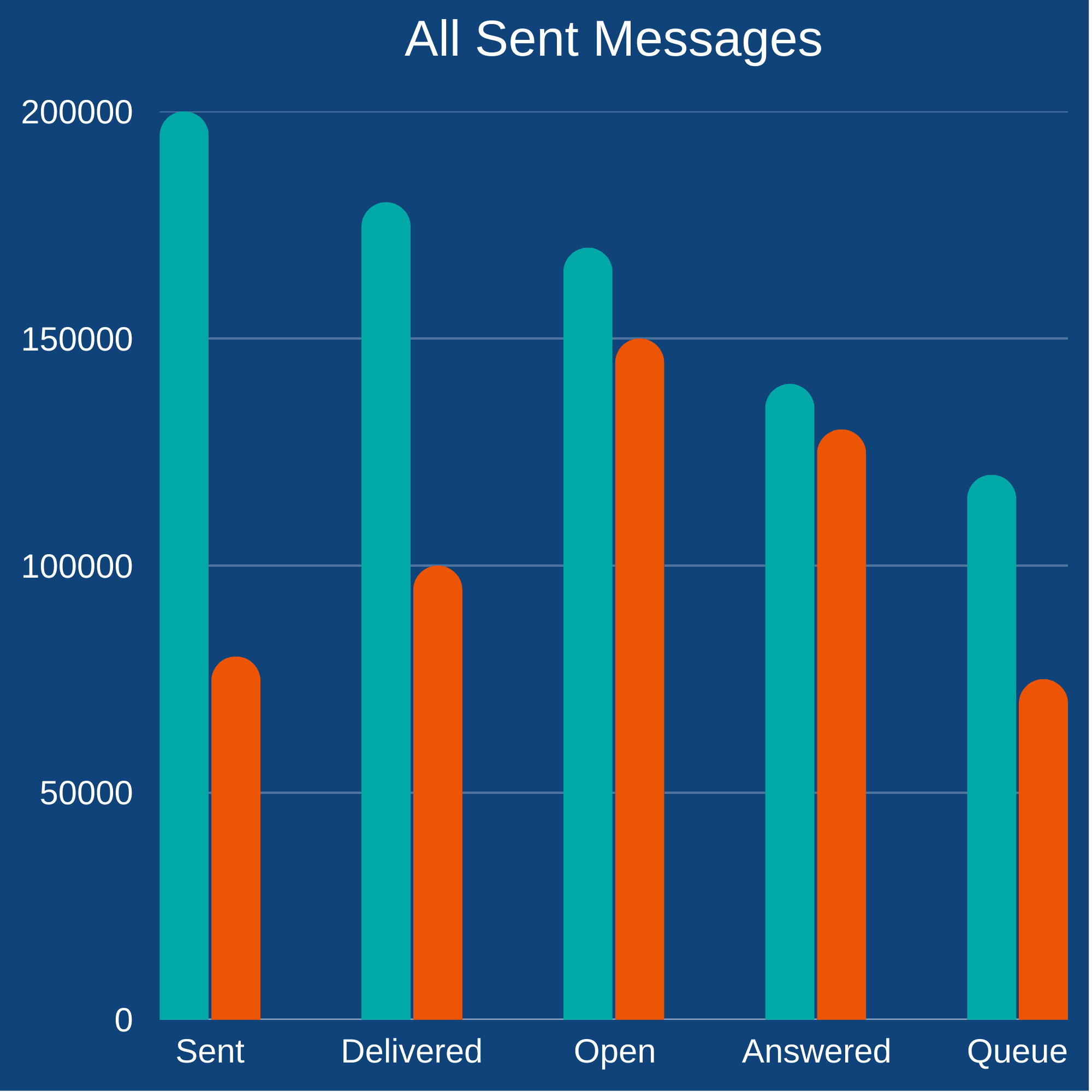

A Measurable, Fast, and Reliable Experience

With Exairon integration, Hepiyi Insurance not only manages customer interactions but also makes these interactions analyzable and improvable. Thanks to the centralized platform structure, teams can monitor performance in real-time and continuously optimize processes.

A Powerful Example of Digitalization in Insurance

The collaboration between Hepiyi Insurance and Exairon provides a powerful example of how the digital customer experience in the insurance sector can be made more effective, faster, and more reliable. This technology-supported structure takes Hepiyi Insurance's customer-centric approach even further in the digital world.

About the Customer

Hepiyi Insurance is an insurance company that aims to add value to the insurance sector and make its customers' lives easier with the innovations it implements, drawing on the 61 years of experience of Doğan Holding.

With its innovative products, strong technological infrastructure, and customer-focused service approach, Hepiyi Insurance stands out among Turkey's most valuable and preferred insurance companies.

Speed, accuracy, and seamless communication are key elements of customer satisfaction in the insurance industry. Hepiyi Insurance has initiated a significant transformation in customer experience by partnering with Exairon to meet these needs and manage digital touchpoints more effectively.

With this integration, Hepiyi Insurance aims to increase the efficiency of its internal teams and offer a more consistent and faster experience to its customers by consolidating its operational processes under a centralized structure.

Effective Digital Communication via WhatsApp

Thanks to the Exairon infrastructure, Hepiyi Insurance uses the WhatsApp channel operationally in an active and segmented manner. Four separate WhatsApp lines, each defined to serve a different need, ensure that operations proceed with the right teams and without delay.

This structure allows customers to quickly receive support through the channel best suited to their requests.

Centralized Management of Customer Experience

Hepiyi Insurance centrally manages all its operational processes through the Exairon Platform under four main headings:

Sales

Customer Service

Claims Processes

Solution Team

Exairon's effective role in inbound and outbound communication processes enables customer requests to be matched with the right teams and the process to be tracked end-to-end.

Automation-Supported Operational Processes

In addition to announcements and informational messages, reminders for missing documents and invoices, especially in claims processes, are automatically generated through the Exairon infrastructure. This automation approach:

Reduces delays in processes,

Lightens the operational load,

Ensures transparent and regular communication with customers.

Campaign and Opportunity Processes

Hepiyi Insurance also manages campaign and opportunity communications centrally and with automation support through the Exairon infrastructure. Marketing-focused campaign announcements, personalized/segment-specific opportunity messages, and periodic notifications are delivered to relevant customers at the right time through planned designs. This approach:

Ensures continuity and consistency in campaign communications,

Facilitates the delivery of the right message to the right target audience,

Increases team efficiency by reducing the need for manual operations,

Supports response and conversion rates by enhancing the customer experience.

A Measurable, Fast, and Reliable Experience

With Exairon integration, Hepiyi Insurance not only manages customer interactions but also makes these interactions analyzable and improvable. Thanks to the centralized platform structure, teams can monitor performance in real-time and continuously optimize processes.

A Powerful Example of Digitalization in Insurance

The collaboration between Hepiyi Insurance and Exairon provides a powerful example of how the digital customer experience in the insurance sector can be made more effective, faster, and more reliable. This technology-supported structure takes Hepiyi Insurance's customer-centric approach even further in the digital world.

Recent Posts

Recent Posts

Similar Blog You May Like

Similar Blog You May Like

Similar Blog You May Like

Transform Your Customer Experience with AI to Grow Your Business

Start transforming your customer experience with Exairon and unlock countless opportunities to scale your business

Transform Your Customer Experience with AI to Grow Your Business

Start transforming your customer experience with Exairon and unlock countless opportunities to scale your business

Transform Your Customer Experience with AI to Grow Your Business

Start transforming your customer experience with Exairon and unlock countless opportunities to scale your business